All Categories

Featured

Table of Contents

A Broker is a person that liaises in between customers and cash lending institutions. In the case of Home loan Brokers, we liaise between our customers who are trying to find finance to acquire a house, and banks that offer cash to home buyers. interest rates. The task of a Home mortgage Broker is to do all the study and legwork for you

This consists of (yet isn't restricted to) looking at the competitive passion rates, one of the most suitable product requirements and payment alternatives. Also though 5 Star Financing Brokers are Home Loan Professionals, we are additionally able to assist bargain terms for personal finances, property finance, commercial financings and can assist with refinancing.

Reputable Home Loan Comparison Near Me – Dalkeith WA

Market organizations: Seek brokers that are participants of the Mortgage & Financing Organization of Australia (MFAA) or the Finance Brokers Association of Australia (FBAA). These organizations have codes of method that members need to comply with past the lawful needs a mortgage broker need to satisfy. Based upon your research study, produce a shortlist of prospective brokers.

Currently comes the enjoyable component interviewing your prospective brokers. Believe of it as rate dating, yet instead of looking for a life companion, you're looking for a financial wingman (or wingwoman).

What are your fees and just how are you paid? Understand their charge framework and whether they obtain payments from loan providers. Can you clarify your process? A good broker should be able to plainly describe just how they'll assist you from begin to finish. How do you figure out which finance is ideal for me? Their solution must show an extensive understanding of your needs and situations.

Personalised Closing Costs (Perth)

While a huge lending institution panel is generally excellent, it's not practically quantity. Inquire about the high quality and variety of their panel. Do they have access to: Major financial institutions Smaller sized lending institutions and cooperative credit union Non-bank lending institutions Expert lending institutions (for instance, if you're independent or have a special situation) A diverse panel guarantees you have accessibility to a wide variety of lending products to match your requirements.

Do you trust them to act in your finest rate of interests? Based on all the above aspects, pick the broker that you believe will ideal offer your demands.

When it concerns making economic choices, have you thought about Pinpoint Money? We have actually helped countless professionals and their households, both in Australia and overseas, in buying their dream homes, updating properties, developing new homes, and growing investment portfolios. oven maintenance. What distinguish is our dedication to taking care of everything from the minute you book an initial chat with us

Leading Refinancing – Dalkeith WA

We conserve you time and headache by doing the research for your application. We'll be your companion, constantly! We are here for your today, tomorrow and future goals. Finalist - Better Company Honors Finest Residential Broker 2020 - Balpreet Singh BalFinalist - Better Service Awards Ideal Customer Support (Workplace) 2020 Victor- WA Young Professional Award 2019 - Balpreet Singh BalFinalist- WA Consumer Service Honor- Individual 2019 - Balpreet Singh BalBalpreet Singh Bal Detailed in Leading 100 Brokers listing by Home mortgage Expert Australia 2017,2018 & 2019Finalist- AMA Broker of the Year 2018 -Balpreet Singh BalFinalist - Better Company Honors Best Residential Broker 2017 - Sharon BalFinalist - MPA Young Gun 2015-2016 - Sharon BalFinalist - MFAA Young Professional 2016 - Sharon BalFinalist - AMA Quality Young Weapon of the year 2016Finalist - ABA Beginner of the year Victor - No.

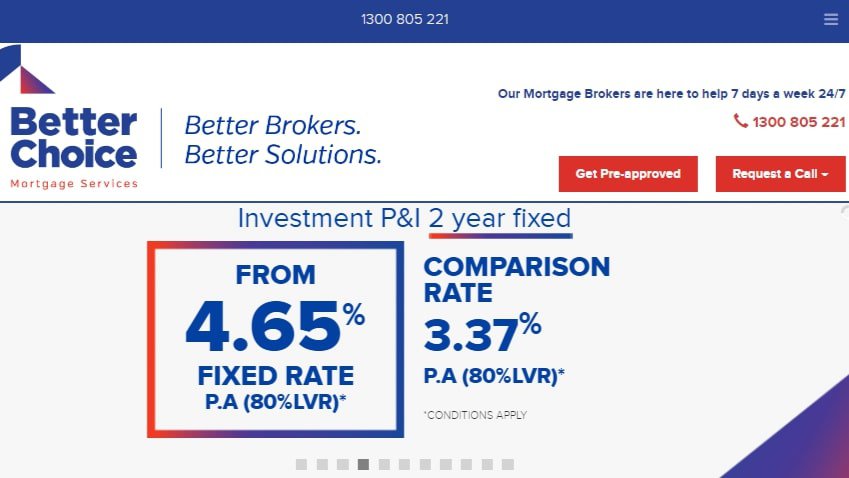

It can be terrifying being a first home purchaser, let Much better Selection aid lead you with the process. Prior to requesting your initial homeowner loan, you need to consider your monetary circumstance and just how a home mortgage will certainly affect you. Extensive study of the property market, the location you want living and the different sorts of mortgage will pay off.

As a very first property buyer, you will require to consider what you can manage to settle in once a week or fortnightly repayments thinking about that added cost comes with possessing your own home. Costs such as county & water prices & maintenance to the house. You need to consider what the settlements on your 1st home finance will certainly be if rate of interest raise.

Better Choice does not bill a cost to process an application for pre-approved money, neither does pre-approved financing obligate you to buy a property. Pre-approved finance typically is legitimate for 3 6 months. A Better Choice Home mortgage Broker is accredited with over 35 various home lending institutions & has every one of the vital information on hundreds of mortgage.

Affordable Rates Commercial Mortgage

Simply remember, in W.A you just obtain a cash grant if you develop or if you purchase a newly developed residential or commercial property that has never ever been lived in. There is additionally a waiver of stamp task for 1st buyers. Our Home mortgage Brokers can clarify all of the conditions affixed to the First Property Owner Grant.

component fixed rates of interest & part variable rate of interest price. And the choices do not quit there. There are different types of variable passion price loans & different sorts of set rates of interest loans. This is why you require the expertise of a Better Selection Home mortgage Broker to aid you browse your method with the home funding process.

This financing provides you certainty on your payment quantity as your rates of interest will certainly not vary throughout the period of the set period. A major advantage to this car loan is that it permits you to spending plan for the next few years. Nevertheless, a set rate loan is inflexible, indicating you can sustain costs if you determine to switch over loans during the dealt with price term.

Typically, variable interest price fundings are a lot more flexible than fixed rate of interest fundings, however there is the threat that a variable interest rate will raise. A split finance is a combination of the fixed rates of interest loan and the variable rates of interest loan. This gives you protection in the understanding that the rate of interest & the settlements on the fixed part will certainly not boost throughout the set term & it also provides you the versatility that includes the variable rate of interest price part of your loan.

Secure Mortgage Calculator

Or the redraw feature which enables you accessibility to any additional settlements you have actually made, in addition to your minimum settlement amount (oven cleaning). One more function is the "honeymoon" price lending, additionally called an introductory home financing. This enables you to pay a much lower passion rate at the start of your car loan, after that the rate of interest reverts to a higher rate of interest in 2- or 3-years' time

Home mortgage can additionally have a repayment holiday function. Based on you entering advancement of your minimum repayments, this function permits you to take a break from settling your finance and can be valuable with temporary changes to your monetary situations. You require to remember that during this period the balance of your finance will be boosting as passion will certainly be included to the balance.

Latest Posts

Value Mortgage Insurance Near Me (Dalkeith WA)

Value Mortgage Terms Near Me – Perth

Proven Home Equity Loan Near Me (Perth 6060 WA)